Income tax Malaysia starting from Year of Assessment 2004 tax filed in 2005 income derived from outside Malaysia and received in Malaysia by a resident individual is exempted from tax. While Budget 2022 had announced that foreign sourced income will be taxed the government has decided to continue.

Corporate Income Tax And Effective Tax Rate Download Table

The same rule applies for income from real estate property situated abroad.

. Dividends interest and royalties from Swiss or foreign sources are included in taxable income. The same corporate and profit taxes will be applied to the taxable income of branches of foreign companies contractors consultant engineers et al Other income earning activities of foreign branches will be subject to taxation on an actual basis ie. For example if you take up a job while overseas and you only receive the payment for the job when you are back in Malaysia.

Such income may only be taken into account to determine the applicable tax rate in case progressive tax rates apply. However in certain cantons special methods of. Income is taxed at 25 per cent less 5 per cent taxes withheld at source.

Taxation of foreign. Citizen with foreign bank accounts totaling more than 10000 must declare them to the IRS and the US. Treasury both on income tax returns and on FinCEN Form 114.

Salary bonuses stock or share-based income foreign-service premiums cost-of-living allowances tax reimbursements and other benefits in kind except for certain tax-exempt items are classified as taxable remuneration employment income. This exempts income that comes from overseas like rental of property or freelance work and also remote working employees of companies that are not based in the country. Finally only income that has its source in Malaysia is taxable.

Japan-source employment income is remuneration earned for services rendered in Japan regardless of where or when. Based on their income tax return as.

:max_bytes(150000):strip_icc():gifv()/TermDefinitions_DeferredTax_V1-7bcdb89b942c43268debeb7043178732.jpg)

Deferred Tax Asset What It Is And How To Calculate And Use It With Examples

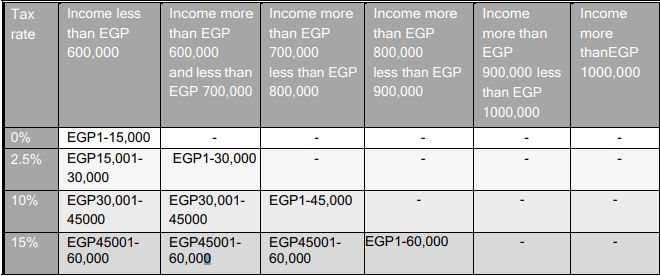

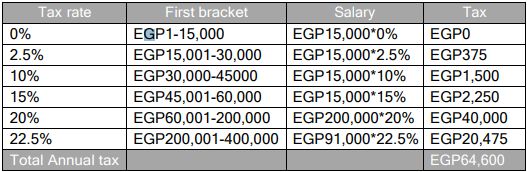

Latest Amendments In Income Tax Law In Egypt Law No 26 2020 Income Tax Egypt

Foreign Income Tax Malaysia Removal Of Exemptions

Taxable Income Formula Calculator Examples With Excel Template

Foreign Companies Expat Tax Professionals

8 Countries With Zero Foreign Income Tax

Effects Of Income Tax Changes On Economic Growth

How To Calculate Your 2013 Expatriate Individual Income Tax In China China Briefing News

Tax Evasion Among The Rich More Widespread Than Previously Thought The Washington Post

Taxable Income Formula Examples How To Calculate Taxable Income

Latest Amendments In Income Tax Law In Egypt Law No 26 2020 Income Tax Egypt

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

Deferred Tax Asset What It Is And How To Calculate And Use It With Examples

/TermDefinitions_DeferredTax_V1-7bcdb89b942c43268debeb7043178732.jpg)